Smart Money Steps: Navigating Currency Exchange in Toronto

Smart Money Steps: Navigating Currency Exchange in Toronto

Blog Article

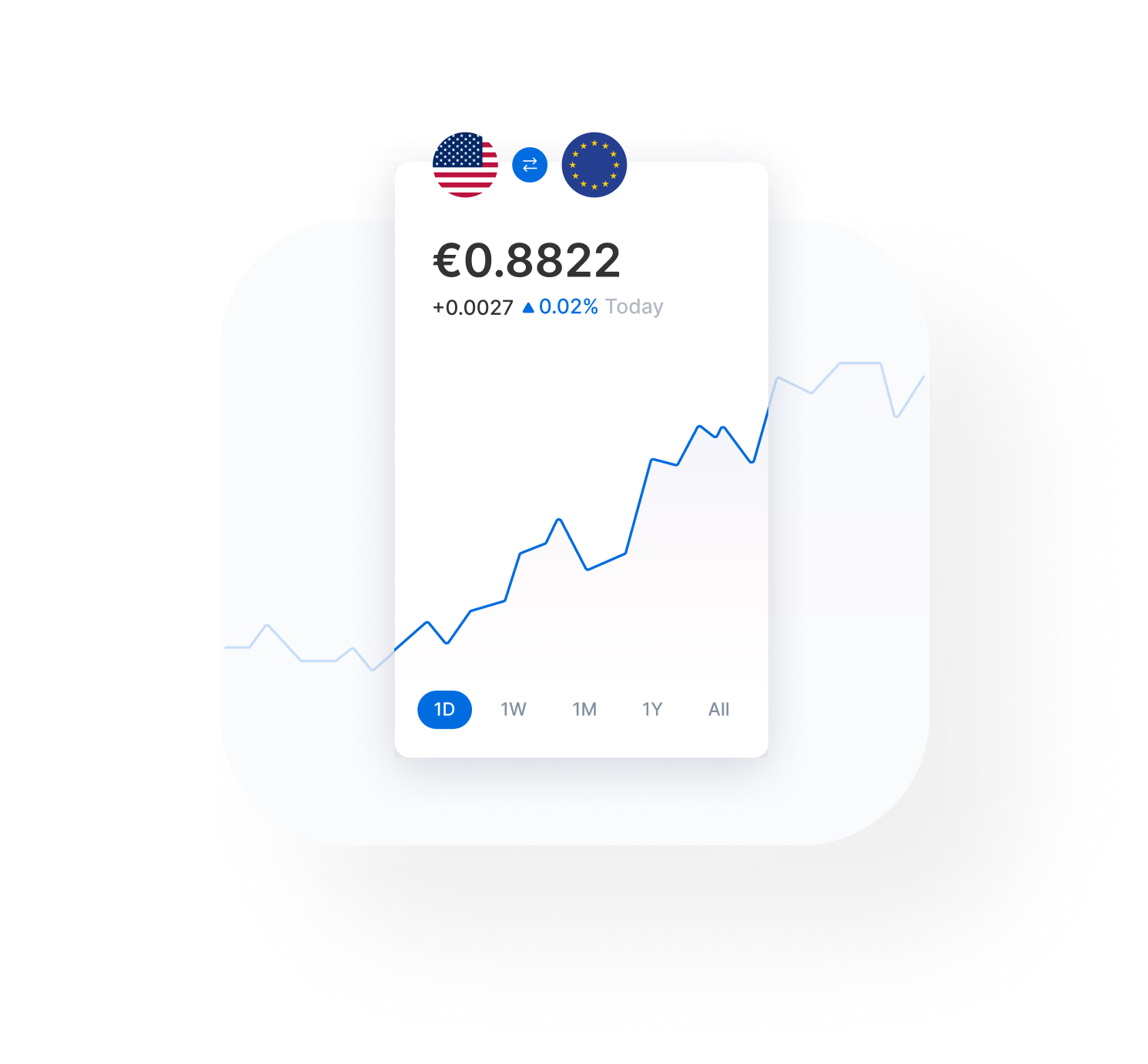

Discover the Tricks to Making Smart Decisions in Currency Exchange Trading

As investors navigate the intricacies of the market, they commonly look for out elusive keys that can give them an edge. By peeling off back the layers of this elaborate landscape, traders may reveal covert insights that could possibly change their technique to money exchange trading.

Recognizing Market Trends

A comprehensive comprehension of market fads is crucial for effective money exchange trading. Market patterns refer to the basic instructions in which the market is conforming time. By understanding these patterns, investors can make even more enlightened choices about when to purchase or market currencies, eventually maximizing their earnings and reducing potential losses.

To properly evaluate market fads, traders usually make use of technical evaluation, which involves studying historical cost charts and using various signs to predict future price movements. currency exchange in toronto. Fundamental analysis is additionally necessary, as it involves examining financial indicators, political events, and other elements that can influence money values

Danger Monitoring Techniques

How can currency exchange investors efficiently minimize potential risks while optimizing their financial investment opportunities? Executing robust risk management methods is vital in the unpredictable world of currency exchange trading. One vital method is setting stop-loss orders to limit losses in case the marketplace relocates against a trader's position. By specifying the optimal loss they agree to birth upfront, traders can secure their capital from substantial declines. Furthermore, expanding the portfolio across various money sets can aid spread threat exposure. By doing this, a negative influence on one currency set might be offset by favorable activities in an additional.

In addition, leveraging devices like hedging can further secure investors from adverse market movements. Hedging involves opening a placement to counter potential losses in another placement, therefore minimizing general threat. Keeping up with financial indicators, geopolitical events, and market belief is additionally crucial for making informed choices and changing methods as necessary. Ultimately, a regimented and calculated strategy to run the risk of management is vital for lasting success in money exchange trading.

Basic Vs. Technical Evaluation

Some traders like basic evaluation for its emphasis on macroeconomic aspects that drive currency values, while others prefer technological analysis for its emphasis on rate trends and patterns. By integrating technological and basic analysis, investors can make even more educated choices and boost their total trading performance - currency exchange in toronto.

Leveraging Trading Tools

With a solid structure in basic and technical evaluation, money exchange investors can considerably improve their decision-making procedure by leveraging different trading tools. One necessary trading device is the economic schedule, which helps investors track vital economic events and statements that could affect money values.

Psychology of Trading

Comprehending the mental facets of trading is necessary for currency exchange traders to navigate the psychological difficulties and prejudices that can impact their decision-making procedure. It is important for investors to cultivate psychological technique and maintain a rational strategy to trading.

One common psychological trap that traders come under is verification prejudice, where they choose information that sustains their presumptions while neglecting contradictory evidence. This can impede their capacity to adapt to altering market problems and make knowledgeable decisions. In addition, the anxiety of losing out (FOMO) can drive investors to go into trades impulsively, without carrying out correct research or evaluation.

Conclusion

To conclude, understanding the art of currency exchange trading requires a deep understanding of market fads, effective danger management methods, knowledge of basic and technological analysis, use of trading devices, and understanding of the psychology of trading (currency exchange in toronto). By incorporating these aspects, investors can make enlightened choices and raise their possibilities of success in the volatile world of currency trading

By peeling off back the layers of this detailed landscape, traders might reveal hidden insights that can potentially transform their strategy to currency exchange trading.

With a solid foundation in technological and fundamental evaluation, money exchange traders can considerably boost their decision-making process by leveraging numerous trading devices. One crucial trading device is the financial schedule, which helps traders track vital financial events and news that might impact currency worths. By leveraging these trading devices in conjunction with basic and technological evaluation, money exchange investors can make smarter and a lot more calculated trading choices in the dynamic forex market.

Understanding the emotional facets content of trading is necessary for money exchange traders to navigate the psychological obstacles and predispositions that can affect their decision-making process.

Report this page